What Are Convertible Bonds . Learn how they work, why. convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into. convertibles are securities, usually bonds or preferred shares, that can be converted into common stock. They offer investors the right to convert their bonds into. convertible bonds are hybrid securities that combine debt and equity features. convertible bonds are debt securities that can be converted into common stock shares. Convertibles are most often associated with. convertible bonds are fixed income securities that can be converted into common stock of the issuing company.

from www.financestrategists.com

convertible bonds are hybrid securities that combine debt and equity features. Convertibles are most often associated with. convertibles are securities, usually bonds or preferred shares, that can be converted into common stock. convertible bonds are debt securities that can be converted into common stock shares. They offer investors the right to convert their bonds into. convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into. convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. convertible bonds are fixed income securities that can be converted into common stock of the issuing company. Learn how they work, why.

Convertible Bonds Definition, Types, Features, Pros, & Cons

What Are Convertible Bonds convertible bonds are debt securities that can be converted into common stock shares. convertible bonds are fixed income securities that can be converted into common stock of the issuing company. They offer investors the right to convert their bonds into. convertibles are securities, usually bonds or preferred shares, that can be converted into common stock. Learn how they work, why. convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into. convertible bonds are debt securities that can be converted into common stock shares. convertible bonds are hybrid securities that combine debt and equity features. Convertibles are most often associated with. convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company.

From mitchellewahardy.blogspot.com

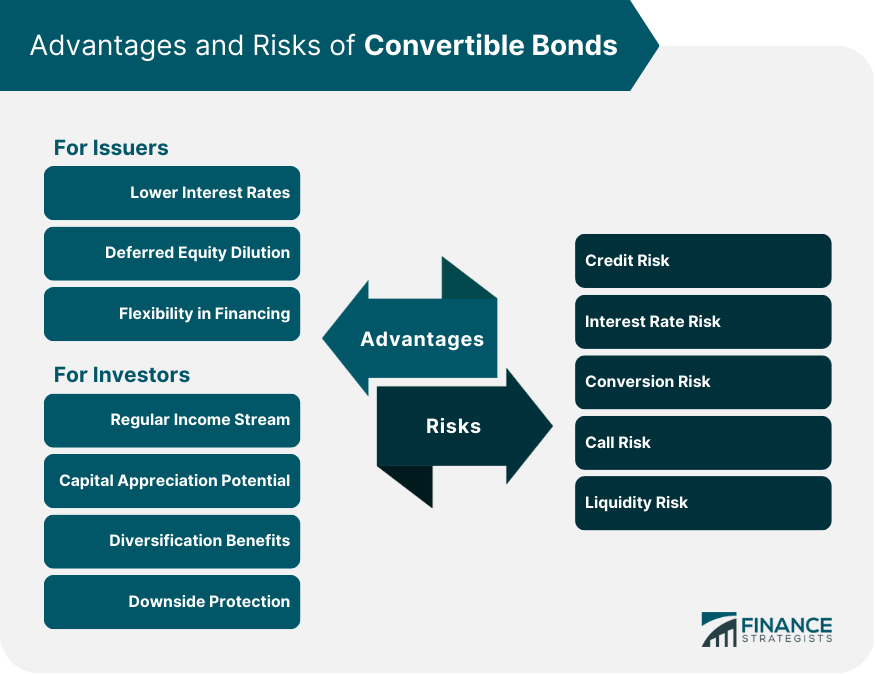

Convertible Bonds Advantages and Disadvantages MitchellewaHardy What Are Convertible Bonds Learn how they work, why. convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into. convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. convertible bonds are debt securities that can be converted into common stock shares. Convertibles are most often associated with. They. What Are Convertible Bonds.

From www.financestrategists.com

Features of Convertible Bonds Finance Strategists What Are Convertible Bonds convertibles are securities, usually bonds or preferred shares, that can be converted into common stock. Learn how they work, why. convertible bonds are debt securities that can be converted into common stock shares. convertible bonds are hybrid securities that combine debt and equity features. convertible bonds are corporate bonds that can be exchanged for common stock. What Are Convertible Bonds.

From convertiblebond.blogspot.com

ConvertibleBond What Are Convertible Bonds convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into. Convertibles are most often associated with. convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. They offer investors the right to convert their bonds into. convertible bonds are fixed income securities that can be. What Are Convertible Bonds.

From efinancemanagement.com

Convertible Bonds Features, Types, Advantages & Disadvantages What Are Convertible Bonds convertibles are securities, usually bonds or preferred shares, that can be converted into common stock. convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into. Learn how they work, why. They offer investors the right to convert their bonds into. convertible bonds are debt securities that can be converted into common. What Are Convertible Bonds.

From studylib.net

Convertible Bonds What Are Convertible Bonds convertibles are securities, usually bonds or preferred shares, that can be converted into common stock. convertible bonds are hybrid securities that combine debt and equity features. convertible bonds are fixed income securities that can be converted into common stock of the issuing company. convertible securities are corporate bonds with an embedded option that allows investors to. What Are Convertible Bonds.

From www.educba.com

Know About The Wonderful Features Of Convertible Bonds eduCBA What Are Convertible Bonds Convertibles are most often associated with. convertible bonds are debt securities that can be converted into common stock shares. convertible bonds are fixed income securities that can be converted into common stock of the issuing company. Learn how they work, why. They offer investors the right to convert their bonds into. convertible bonds are hybrid securities that. What Are Convertible Bonds.

From www.go-yubi.com

Investing In Convertible Bonds? Learn About The Pros & Cons What Are Convertible Bonds Convertibles are most often associated with. Learn how they work, why. convertibles are securities, usually bonds or preferred shares, that can be converted into common stock. convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into. convertible bonds are fixed income securities that can be converted into common stock of the. What Are Convertible Bonds.

From stockanalysis.com

Convertible Securities Definition, Pros, and Cons Stock Analysis What Are Convertible Bonds convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Learn how they work, why. convertible bonds are hybrid securities that combine debt and equity features. convertible bonds are fixed income securities that can be converted into common stock of the issuing company. convertibles are securities, usually bonds or preferred. What Are Convertible Bonds.

From www.managementnote.com

What are Convertible Bonds? What Are Convertible Bonds Convertibles are most often associated with. convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Learn how they work, why. convertible bonds are debt securities that can be converted into common stock shares. They offer investors the right to convert their bonds into. convertible bonds are hybrid securities that combine. What Are Convertible Bonds.

From www.slideserve.com

PPT Investing in Bonds PowerPoint Presentation, free download ID What Are Convertible Bonds convertible bonds are debt securities that can be converted into common stock shares. convertibles are securities, usually bonds or preferred shares, that can be converted into common stock. Convertibles are most often associated with. convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into. They offer investors the right to convert. What Are Convertible Bonds.

From eqvista.com

Convertible Bond Everything you need to know Eqvista What Are Convertible Bonds convertible bonds are fixed income securities that can be converted into common stock of the issuing company. convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. convertible bonds are debt securities that can be converted into common stock shares. Convertibles are most often associated with. convertible bonds are hybrid. What Are Convertible Bonds.

From writingley.com

What are convertible bonds and how do they work Writingley What Are Convertible Bonds Convertibles are most often associated with. They offer investors the right to convert their bonds into. convertible bonds are fixed income securities that can be converted into common stock of the issuing company. convertible bonds are hybrid securities that combine debt and equity features. convertible securities are corporate bonds with an embedded option that allows investors to. What Are Convertible Bonds.

From tavaga.com

Convertible Bond And Its Types Tavaga Tavagapedia What Are Convertible Bonds Learn how they work, why. convertible bonds are debt securities that can be converted into common stock shares. Convertibles are most often associated with. convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into. convertible bonds are fixed income securities that can be converted into common stock of the issuing company.. What Are Convertible Bonds.

From www.bajajfinservsecurities.in

Convertible Bond Meaning, Types, Pros, and Cons What Are Convertible Bonds convertible bonds are fixed income securities that can be converted into common stock of the issuing company. convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. They offer investors the right to convert their bonds into. convertibles are securities, usually bonds or preferred shares, that can be converted into common. What Are Convertible Bonds.

From financeplusinsurance.com

Convertible Bonds Meaning, Examples, Types, Benefits, Pros What Are Convertible Bonds convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into. convertible bonds are debt securities that can be converted into common stock shares. They offer investors the right to convert their bonds into. convertible bonds are hybrid securities that combine debt and equity features. Learn how they work, why. convertible. What Are Convertible Bonds.

From www.financestrategists.com

Convertible Bonds Definition, Types, Features, Pros, & Cons What Are Convertible Bonds They offer investors the right to convert their bonds into. convertible bonds are fixed income securities that can be converted into common stock of the issuing company. convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into. convertibles are securities, usually bonds or preferred shares, that can be converted into common. What Are Convertible Bonds.

From www.slideshare.net

CONVERTIBLE BOND What Are Convertible Bonds convertible bonds are fixed income securities that can be converted into common stock of the issuing company. convertible bonds are debt securities that can be converted into common stock shares. They offer investors the right to convert their bonds into. convertible bonds are hybrid securities that combine debt and equity features. Learn how they work, why. . What Are Convertible Bonds.

From www.investopedia.com

Convertible Bond Definition, Example, and Benefits What Are Convertible Bonds Convertibles are most often associated with. Learn how they work, why. convertible bonds are hybrid securities that combine debt and equity features. convertibles are securities, usually bonds or preferred shares, that can be converted into common stock. convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. convertible securities are. What Are Convertible Bonds.